A few years ago, I made a list of relevant investors that I wanted to approach when I was fund raising for my startup. I kept that list up to date as I went through the funding rounds.

Forward a few years and I was at Techstars. Founders approached me all the time and said: „Whom shall I approach for fund raising?“ So I took my Excel list, added more investors, turned it into an online spreadsheet and shared it with the Techstars founders.

Then something unexpected happened. I was in hospital, waiting for my wife to give birth to our second child. In that particular moment, Phil Wilkinson decided to share my spreadsheet on Twitter (thanks Phil! 🙂 ) Within an hour, I had hundreds of founders who asked to be given access to the list. They then gave permission to yet other founders and investors and so forth. Within a day, the sharing permissions of the spreadsheet were completely broken, my inbox was flooded, and the crowd had taken over. My daughter obviously didn’t mind, she was happily born later that night.

In the next days, I created a new, clean spreadsheet with clean access privileges and moved the old spreadsheet information across. This sheet has been used by 1000s of founders ever since, there are typically a few dozen people on it every time I look.

But there were lots of problems with the new spreadsheet. People link forms to it by accident. People write the most annoying things into it. Other people are threatening to sue me over some of those things. Funds are deleted for no reason, incorrect information gets added, versions get rolled back and forth without control.

In addition, the information was useful for me, but not so useful of the founders. I knew which funds were interested in which geographies and sectors. So I ended up explaining each fund to each founder: „This is a Swedish VC that makes Series A investment in Nordic companies…“ and so on ad so forth.

So after a while, I stopped using my own spreadsheet. Instead, I copied it, created a private version, tidied it up and started making it a lot better. I added fields, so I don’t need to explain each investor anymore, it is now completely obvious what they do and where they focus.

I then gave comment only access to the founders in the Techstars Berlin class.

By now, the list is starting to take on a life of its own again. History repeats. The new sheet now has more concurrent users than the old one. There are far more investors on it. The structure of the information is much better. Most importantly, only a very small number of people can make edits. Everybody can comment though, and contribute in this way.

So, in the last few days we did a little count and found that just the funds that we have listed on this spreadsheet that are currently actively looking to invest in European startups total some €15 Billion. Lots more than I thought. And that doesn’t even include all the money family offices etc have to invest.

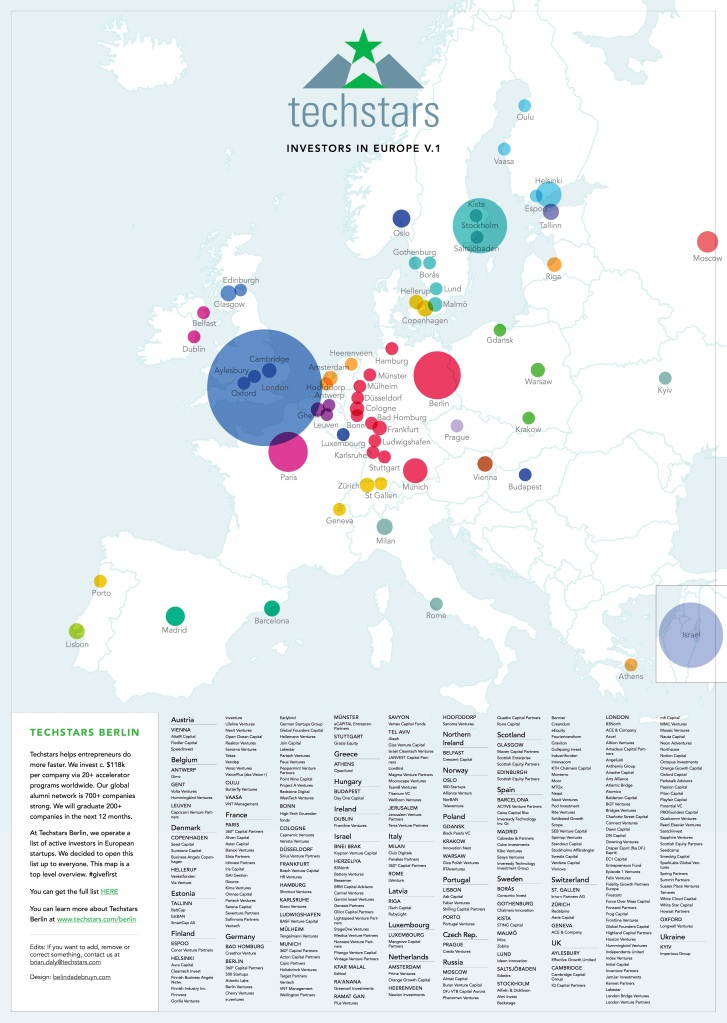

We also made a little map that visualizes where these funds are located (Investors from outside of Europe investing in Europe are not shown).

The list is open, everybody can access it, everybody can contribute to it (either via comments or by emailing us). This time it is not just me, but I am putting some Techstars’ resources behind it to make it awesome and keep it up to date. We will keep adding investors to it, until we have all investors on it that routinely make investment in European startups.

So far, €15BN and counting…lots more to come.

#givefirst